How MS affects your finances: Insurance, disability, and budgeting

Last updated Sept. 16, 2025, by Lindsay Modglin

For many people with multiple sclerosis (MS), MS and finances are closely connected. After an MS diagnosis, juggling treatment costs, insurance considerations, and everyday expenses can start to feel overwhelming.

While managing MS and money can be challenging at times, there are resources, strategies, and benefits available to help you handle your finances alongside your health.

The financial impact of MS

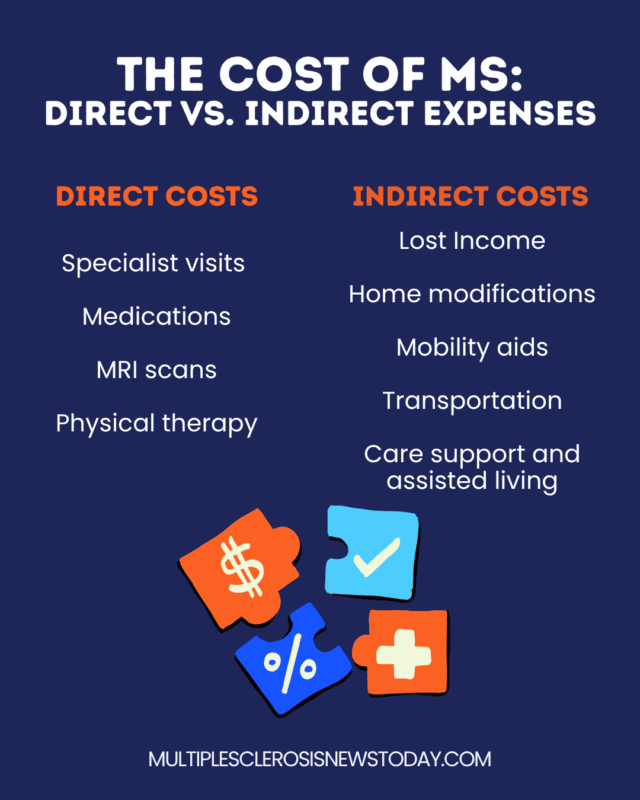

Living with MS can lead to unexpected costs that may strain your budget, with MS treatment expenses representing the most obvious financial impact.

A 2022 study estimated the average cost of living with MS at approximately $88,487 per year. These MS and out-of-pocket expenses may include specialist visits, magnetic resonance imaging (MRI) scans, physical therapy, and medications beyond your primary treatments.

Indirect costs

Indirect costs are also a concern. You may need to reduce your work hours or take time off for appointments and flare-ups, which could directly affect your income.

You may also need to modify your home for accessibility or purchase mobility aids. Transportation costs can also increase if you’re unable to drive during relapses.

Long-term financial considerations

Long-term considerations include the potential for progressive disability that may require more intensive care, home modifications, or assisted living arrangements.

Planning early for these possibilities can help you avoid financial stress later, when your MS symptoms may make it harder to manage complex financial decisions.

Navigating health insurance with MS

Health insurance coverage for MS requires careful consideration, as your decision can dramatically impact out-of-pocket costs and treatment access.

When comparing employer-sponsored and individual plans, employer plans often provide better coverage for chronic conditions like MS. However, you should always review the plan details carefully. Look for health insurance that offers comprehensive prescription coverage, as paying for MS medications can add up fast.

Keep the following tips in mind when choosing a health plan:

- Ensure your insurance plan covers the MS medications your doctor recommends by reviewing the plan’s drug formulary.

- Check if a prior authorization is needed for any of your medications.

- Verify that neurologists and other MS specialists are in your network.

- Look for lower copays and annual out-of-pocket maximums to cap your yearly costs.

- Consider talking to an expert about health insurance for MS, including plan options and coverage details.

Other tips for choosing the right plan during open enrollment include:

- reviewing your current medications and treatments

- estimating your annual healthcare costs

- considering whether a Health Savings Account (HSA) might help.

Disability benefits and work accommodations

MS disability benefits can provide crucial financial support when MS affects your ability to work, but understanding your options takes some research.

Short-term and long-term disability insurance through your employer can replace a portion of your income if MS prevents you from working. Review your current coverage to understand the waiting periods, benefit amounts, and payment duration. You can also talk to your human resources (HR) department to learn more about your company’s disability options.

It is important to note that long-term disability MS claims require thorough documentation from your healthcare team. Start building this documentation early by keeping detailed records of your symptoms, treatments, and how MS affects your daily activities.

Additionally, workplace rights and accommodations under the Americans with Disabilities Act (ADA) can help you continue working longer. MS workplace accommodations might include flexible schedules, work-from-home options, ergonomic equipment, or modified duties.

These ADA and MS rights protect you from discrimination and entitle you to reasonable accommodations that don’t create undue hardship for your employer.

Can you get disability for MS?

Yes, you can get disability for MS via Social Security Disability Insurance (SSDI), but it depends on how significantly your symptoms affect your ability to work. SSDI and multiple sclerosis benefits are available if your MS prevents you from working for at least 12 months and you meet other eligibility criteria.

The Social Security Administration (SSA) evaluates MS cases based on how your symptoms affect your daily functioning and work capacity. You can apply for benefits on the SSA.gov website.

Budgeting basics for life with MS

Financial planning with MS means creating a flexible budget that adapts to medical expenses and changes in income. Start by tracking your current MS-related costs and expenses to get a clear picture of your health spending. Be sure to include a buffer for unexpected costs, such as expenses due to relapses or disease progression.

Planning for future expenses also means considering potential needs like home modifications, mobility equipment, or increased care costs. Researching these costs in your area can help you set realistic savings goals.

Many financial experts suggest saving three to six months’ worth of expenses in an emergency fund for health-related disruptions. However, it’s worth considering setting an even higher goal. Start small and build your fund gradually, even if you can only save a little each month.

It may be helpful to use tracking tools or other resources to monitor your MS-related expenses for tax deductions and insurance claims. Many smartphone apps can photograph and categorize receipts, which may make it easier for managing medical bills with MS.

Where to turn for extra help

MS financial assistance programs and MS nonprofit financial help can provide crucial support when other resources feel stretched thin. These programs can help with various expenses, including paying for MS drugs.

- Grants and emergency assistance programs can help with utilities, groceries, and other necessities. Examples include Help Hope Live, the MS Focus’ Emergency Assistance Grant, and the PAN Foundation.

- Most drug manufacturers offer MS patient assistance programs, and some provide medications at no cost for qualifying individuals.

- Local MS chapters of larger organizations and noprofits may offer financial assistance for specific needs, like travel or medication costs.

- Local or state support services may include Medicaid programs, prescription assistance programs, and utility assistance programs. Contact your state’s Department of Health or aging services to learn about available programs where you are.

- Financial counseling services geared toward chronic illness financial support can help you create realistic budgets while planning for your financial future. Many hospitals offer these or similar services.

While managing finances with MS can sometimes feel stressful, knowing your options — from insurance and disability benefits to budgeting tools and financial assistance programs — can help you navigate these challenges.

By planning ahead and accessing available resources, you can focus on your health while maintaining stability and confidence in your financial future.

Multiple Sclerosis News Today is strictly a news and information website about the disease. It does not provide medical advice, diagnosis, or treatment. This content is not intended to be a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified health provider with any questions you may have regarding a medical condition. Never disregard professional medical advice or delay in seeking it because of something you have read on this website.

Recommended Posts

- Fenebrutinib again bests Aubagio in trial at cutting MS relapse rates

- I don’t have to be an Olympic medalist to achieve remarkable things

- New study links specific MRI lesion pattern to MS risk before symptoms

- With MS, parenting a teenager can get a little bloody — for dad

- Foralumab reduces microglial activity, inflammation in nonactive SPMS